English

uni实人认证依赖 HBuilderX 3.7.6+,目前仅支持App平台。

uni实人认证,即核验终端操作者的真实身份,搭载真人检测和人脸比对等生物识别技术,可快速校验自然人的真实身份。

uni实人认证是金融级实人认证,供应商为阿里云,背后依托公安部数据库,具备国家认可的权威资质。该产品中应用的活体防攻算法获得了 iBeta 国际安全组织最高等级的 Level2 认证,是目前中国国内少数获得此认证的产品之一,是首批获得国家面向金融行业和移动电子政务行业相关认证资质的产品。

Different from mobile phone number verification, real-person authentication inputs name + ID number, performs face recognition and liveness detection, and then returns the comparison result: that is, whether the face in front of the camera matches the name and ID number.

针对使用对象和认证对象,uni实人认证服务的使用要求如下:

使用对象

在使用前,请确保您已注册DCloud账号,并已完成实名认证。更多信息,请参见uni实人认证开通指南

认证对象

目前,uni实人认证服务仅支持对拥有以下证件的居民进行认证:

uni实人认证具备便宜、安全、准确、稳定、实时、可靠等优势,提供多样化的产品方案和接入类型,满足您核验用户身份信息真实性的需求。

uni实人认证,主要用于政务和防刷。

It's easy to get hacked when developers offer promotions or hand out perks. Real person authentication, combined with uniCloud secure network, can be foolproof.

Typical scenarios: comprehensive digital government affairs, epidemic prevention, provident fund extraction, industrial and commercial enterprise registration, etc.

In response to the call of the country, local governments continue to launch online processing services. Users can use the government app client to call face authentication services for identity authentication, make appointments or directly handle various businesses online.

Typical scenarios: content publishing, equity exchange risk control, online signing, etc.

Typical scenarios: real-name authentication, snap-up of digital collections, bank card binding.

The digital collection business involves online buying and selling transactions and the attribution of digital collections, so identity verification must be performed before digital collection purchase business operations can be carried out.

Typical scenarios: mobile phone binding, insurance application, insurance renewal, etc.

Since the outbreak of the new crown epidemic, the traditional face-to-face insurance purchase model has changed. The policyholder needs to apply for and renew the insurance through the Internet. From the aspect of compliance, the identity of the policyholder needs to be verified. In order to prevent false insurance policies caused by identity forgery, the insurance Companies need high-security policy identity verification capabilities.

Typical scenarios: transfers, video teller transactions, certificate changes, electronic contract signing, customer card opening, credit authorization, online verification, etc.

Most banks of a certain size have already privatized and deployed a real-person authentication platform, which has high maintenance costs and a low pass rate. After the bank accesses the face authentication service in the cloud, the overall pass rate of face authentication has increased significantly, and the risks are controllable.

Typical scenarios: driver registration, order acceptance, passenger release itinerary, airport security boarding, railway security check ticket purchase, long-distance passenger transport ticket purchase, border inspection port customs clearance.

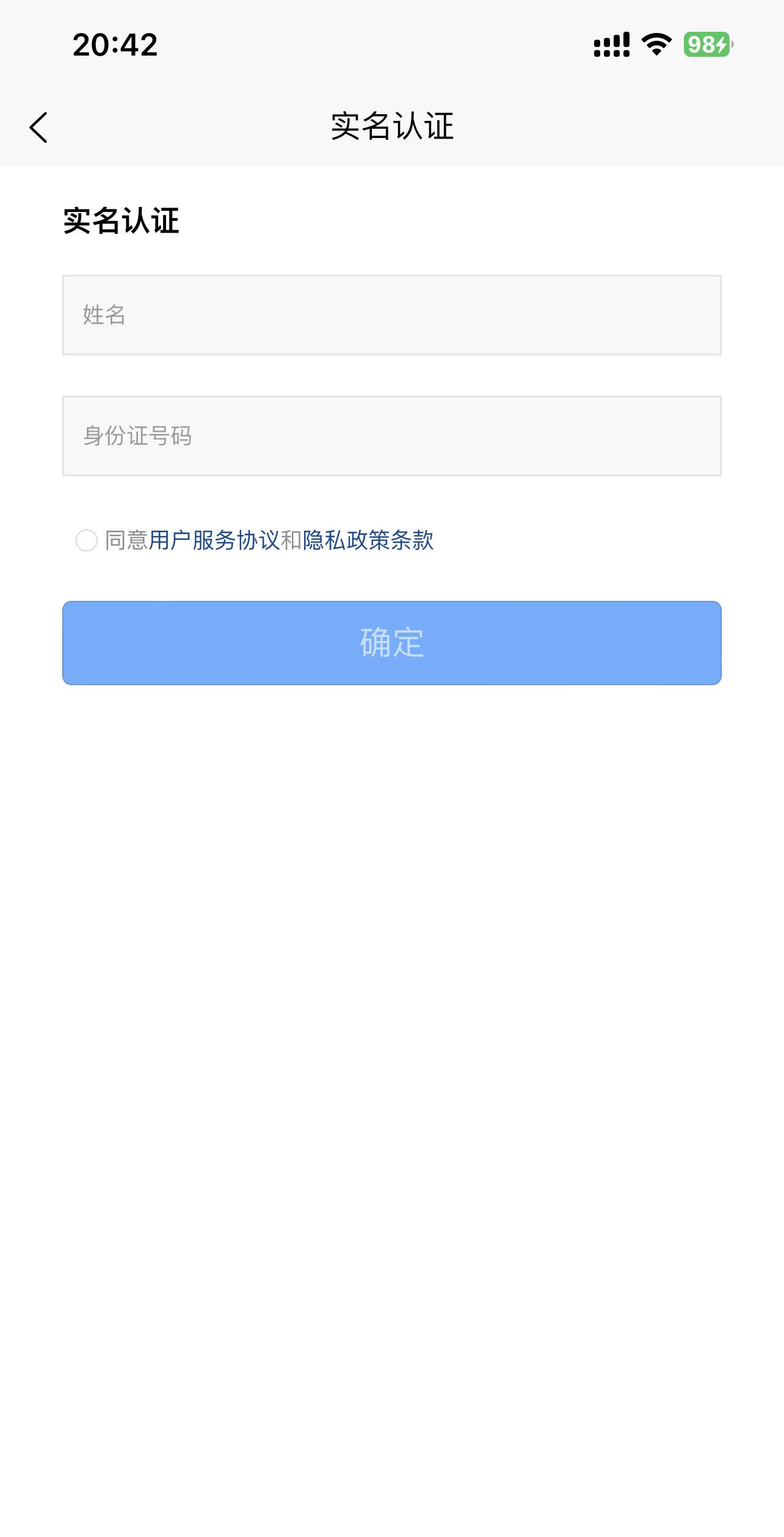

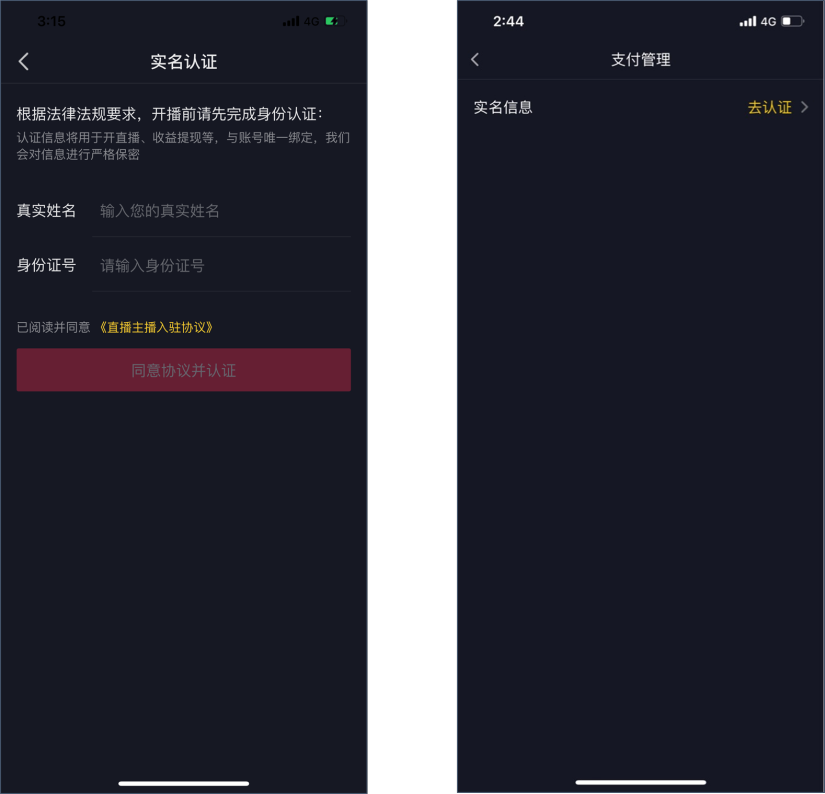

Typical scenario: user’s real name, binding payment, and cash withdrawal before the first live broadcast.

The live broadcast industry needs to retain the real information of user identities due to the need for strong national supervision. The traditional method is to require the user to submit a hand-held certificate, a copy of the front and back of the ID card, and manually verify that the user is the ID card holder himself, which is time-consuming and laborious. By invoking the face authentication service, the process efficiency and experience of anchor registration, live broadcast, and capital transactions can be greatly improved.

Typical scenarios: credit score improvement, job posting, resume delivery, interviewer identity verification.

The recruitment platform app involves the authenticity of candidates' resume information, the authenticity of headhunters and interviewers, and requires user identity verification. The verification process of traditional handheld ID cards is complicated and the success rate is low. By accessing the face authentication service, it helps the platform to identify users more accurately.